Moving to a new country is an exciting adventure, but it also comes with financial adjustments. One of the most important steps in setting yourself up for success in Canada is establishing a strong credit history. A good credit score can open doors to better financial opportunities, from securing loans to getting approved for a mortgage. The sooner you start building your

credit, the better positioned you’ll be for a stable financial future.

Here’s everything you need to know about credit scores in Canada and how to build yours successfully.

What Is a Credit Score and Why Does It Matter?

Your credit score is a three-digit number (ranging from 300 to 900) that reflects your financial reliability. It’s based on your credit history, which starts as soon as you get a credit card, loan, or line of credit. Lenders use this score to assess your creditworthiness—in other words, how risky it is to lend you money.

A higher credit score means better loan approval rates, lower interest rates, and easier access to financial opportunities. Your score will be checked when you apply for:

✔ Mortgages to buy a home

✔ Car loans and leases

✔ Credit cards

✔ Rental applications (many landlords review credit reports before approving tenants)

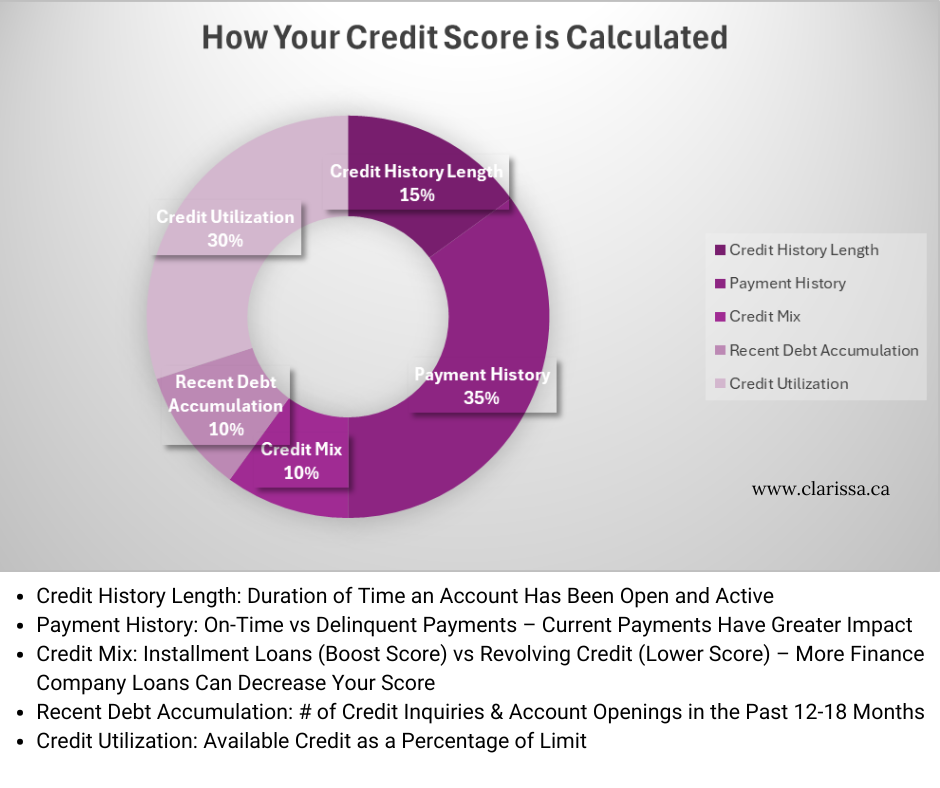

How Is Your Credit Score Calculated?

Your credit score is determined by two major credit bureaus in Canada: Equifax Canada and TransUnion Canada. They use a complex algorithm based on factors such as:

🔹 Payment history (35%) – Paying your bills on time is the most important factor. Even one late payment can negatively impact your score.

🔹 Credit utilization (30%) – How much of your available credit you’re using. Try to keep credit card balances below 30% of your limit.

🔹 Length of credit history (15%) – The longer you’ve had credit accounts open, the better.

🔹 Types of credit (10%) – A mix of credit cards, loans, and lines of credit can boost your score.

🔹 New credit inquiries (10%) – Every time you apply for a new credit card or loan, a hard inquiry is made, which can slightly lower your score.

How to Build Your Credit Score in Canada

Since lenders want to see an established credit history before approving you for loans, you need to start building credit as soon as possible. Here’s how:

1. Apply for a Secured Credit Card

The easiest way to build credit is by using a credit card. If you’re not approved for a traditional one, ask for a secured credit card, which requires a refundable deposit. Retail credit cards (from stores like The Bay or Canadian Tire) are also often easier to get approved for.

💡 Pro Tip: Use your credit card regularly for small purchases—coffee, groceries, gas—but always pay it off in full each month to avoid interest charges.

2. Limit the Number of Credit Cards You Open

It may be tempting to open multiple credit cards to boost your credit history, but every new credit application creates a hard inquiry on your report, which can lower your score. Stick to one or two cards and use them responsibly.

3. Get Separate Credit Cards for Both Partners

If you’re in a relationship, both partners should apply for their own credit cards instead of being a supplementary cardholder. This ensures both individuals establish a strong credit history, which is beneficial when applying for a mortgage or other joint loans in the future.

4. Pay Bills on Time, Every Time

Payment history is the most important factor in your credit score. Always pay:

✔ Credit card bills

✔ Phone bills

✔ Utilities (electricity, water, internet, etc.)

✔ Insurance premiums

💡 Missed or late payments can significantly hurt your credit score. If possible, set up automatic payments to avoid forgetting due dates.

5. Keep Credit Utilization Low

Even if you have a high credit limit, avoid using too much of it. Try to keep your credit utilization below 30% of your total available credit. For example, if you have a $10,000 limit, aim to keep your balance below $3,000.

6. Open a Savings Account

Opening a high-interest savings account can help demonstrate financial responsibility to banks and lenders. Bonus Tip: Consider a Tax-Free Savings Account (TFSA) to maximize your savings while minimizing taxes.

Why You Should Check Your Credit Score Regularly

Many Canadians don’t track their credit score, which can lead to missed errors or even fraud. Reviewing your credit report regularly helps:

✔ Prevent identity theft – If someone illegally opens a credit account in your name, you can catch it early.

✔ Understand why you were declined – If a loan or credit card application is rejected, checking your report can help identify the issue.

✔ Keep your records updated – Ensure closed accounts are properly reported and correct any inaccuracies.

💡 Checking your own credit report does NOT affect your score! You can request a free report from Equifax Canada or TransUnion Canada once a year.

Understanding Your Score: What’s a Good Credit Score?

|

Credit Score Range |

Rating |

What It Means |

|

800 - 900 |

Excellent |

You’ll qualify for the best interest rates and highest credit limits. |

|

700 - 799 |

Very Good |

You’re seen as a low-risk borrower with access to good loan options. |

|

650 - 699 |

Good |

You can still get approved for loans, but interest rates may be slightly higher. |

|

600 - 649 |

Fair |

Lenders may see you as a moderate risk and charge higher interest rates. |

|

Below 600 |

Poor |

You may struggle to get approved for loans, and if approved, rates will be much higher. |

Aiming for a credit score of 700 or higher will give you access to the best financial opportunities.

Final Thoughts: Start Building Your Credit Today!

Your credit score is your financial reputation—it affects your ability to buy a home, lease a car, and even get approved for rental housing. The sooner you start building a strong credit history, the better.

Links to check out: https://www.equifax.ca and transunion.ca

💬 Have questions about credit scores, mortgages, or financial planning for your home purchase? I’d be happy to help! Contact me anytime at clarissa@clarissa.ca or by calling (647) 215-7407. My website www.clarissa.ca has more real estate resources and listings to help you out.

Post a comment